I led the LBG’s Commercial Design Team, applying a service design and UX-led approach, supported by behavioural science and cross-functional collaboration.

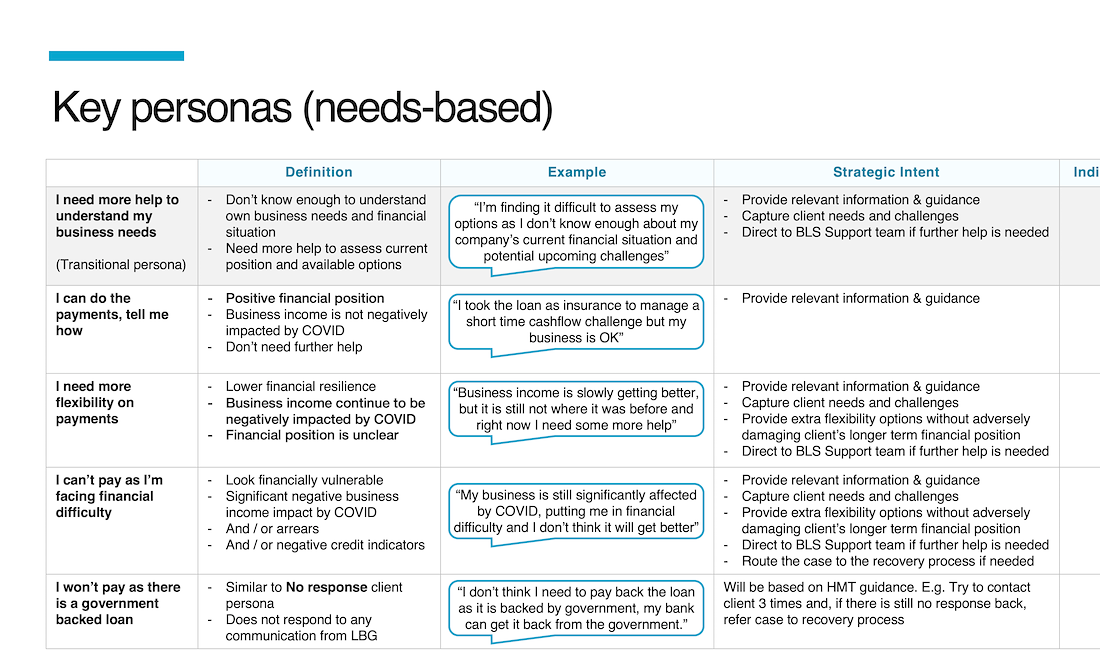

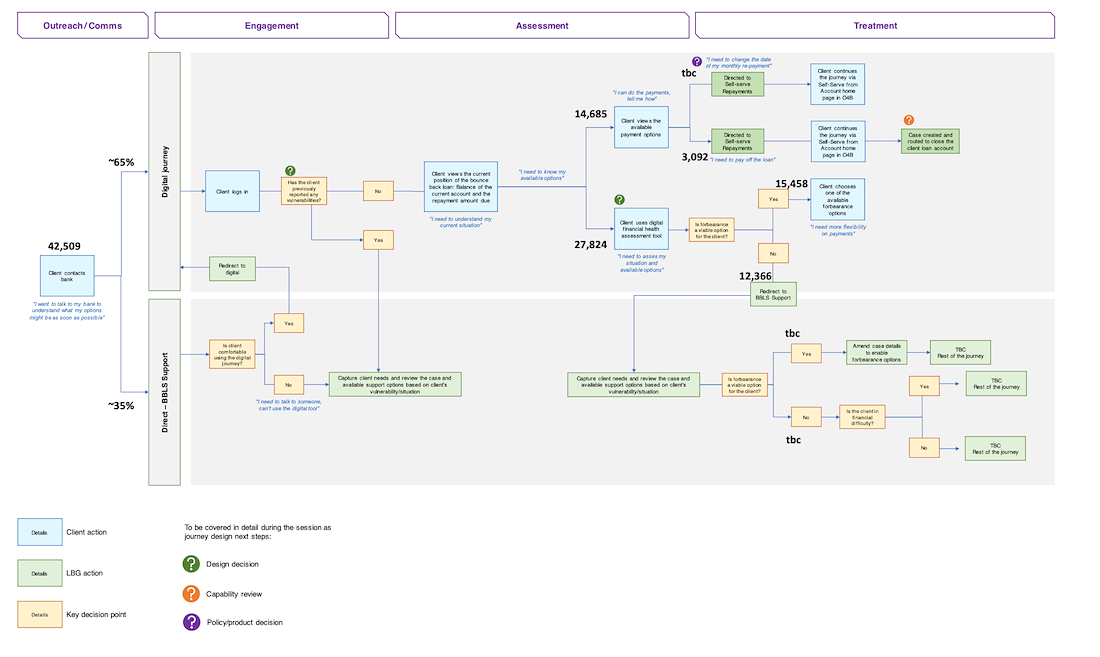

1- Customer Understanding & Segmentation

• Mapped customer personas by needs, repayment readiness, and vulnerability indicators.

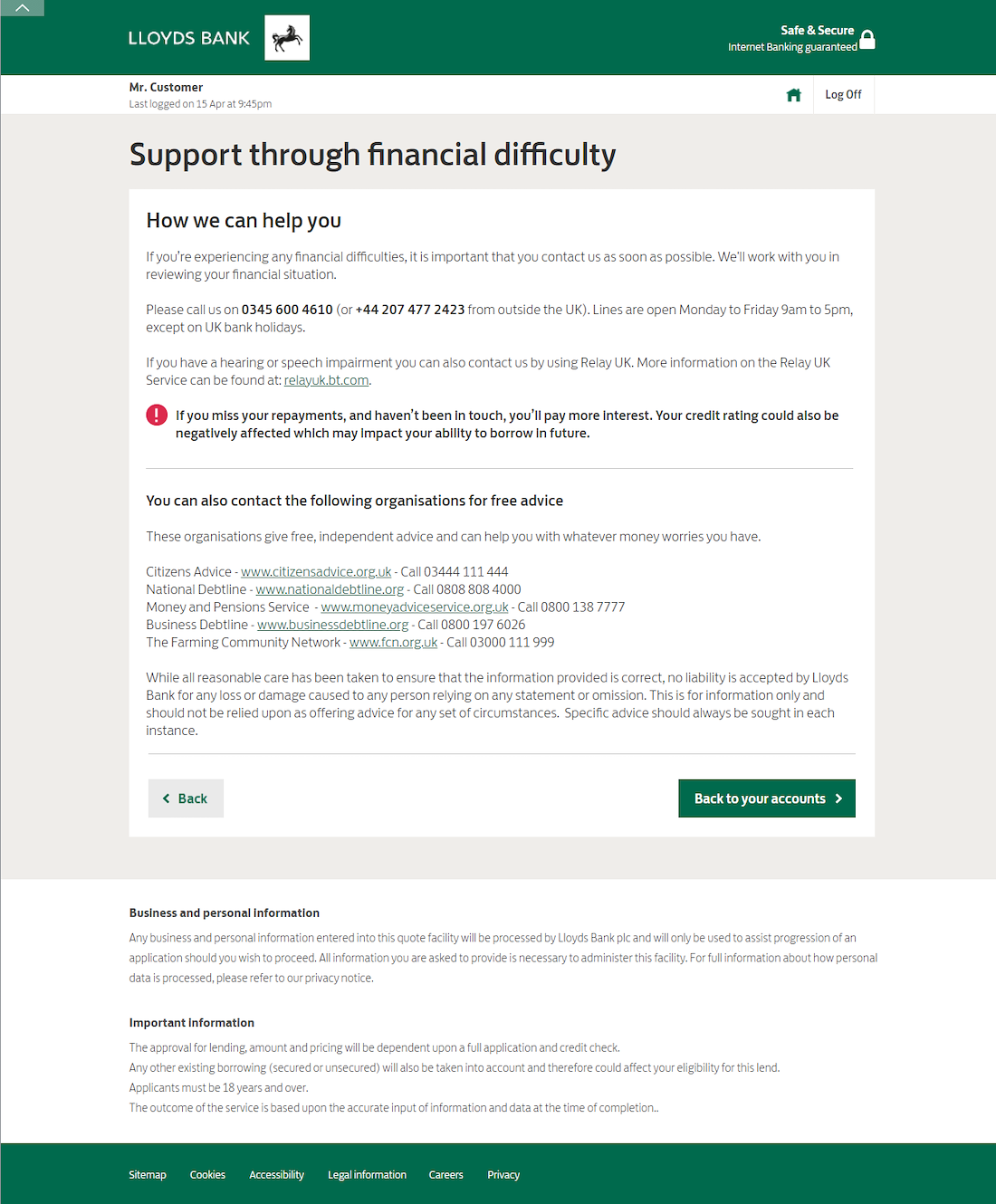

• Created tailored pathways for digital-first users vs. customers needing offline support.

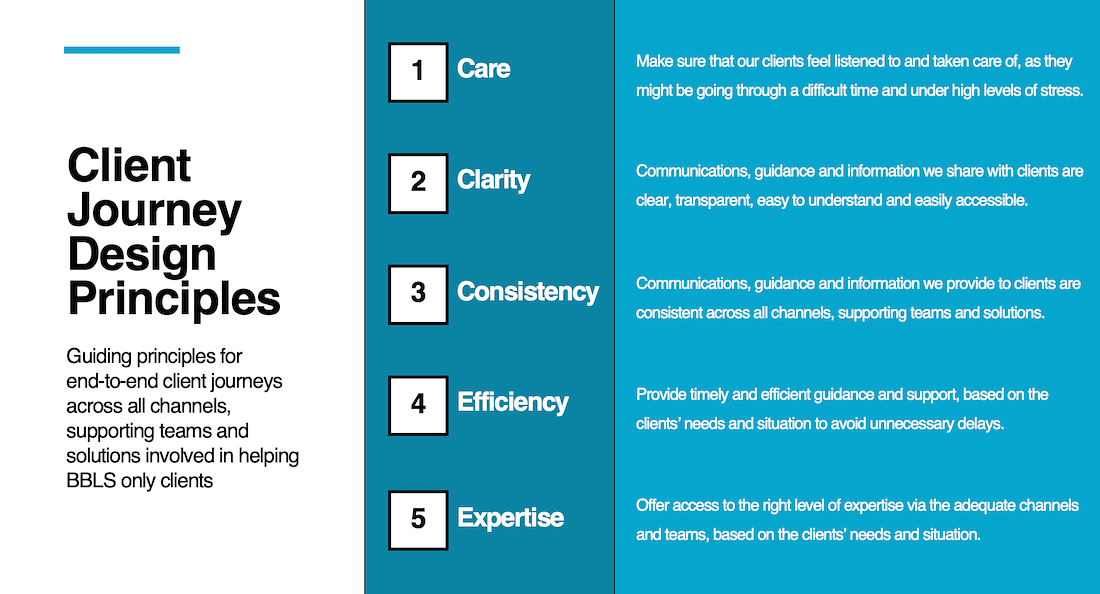

2- Experience Principles

I led the definition of the BBLs program experience principles and established agreement across all key commercial bank senior stakeholders sponsoring the program. They were the guiding principles for end-to-end customer journeys across all channels, supporting teams, and solutions involved in helping BBLS customers.

Empathy: Understanding our customers as individuals with their own perspectives, feelings, and experiences so we can be genuinely by their side and better able to help.

Clarity: Communications, guidance, and information we share with customers are clear, transparent, in compliance with policy, easy to understand, and easily accessible.

Consistency: Communications, guidance, and information we provide to customers are consistent across all channels, effectively supporting teams and solutions.

Efficiency: Provide timely and efficient guidance and support, based on the customers’ needs and situation, to avoid unnecessary delays.

Expertise: Offer access to the right level of expertise via adequate channels and teams, based on the customers’ needs and situation.

Accessibility: Support for customers with limited digital skills or access.

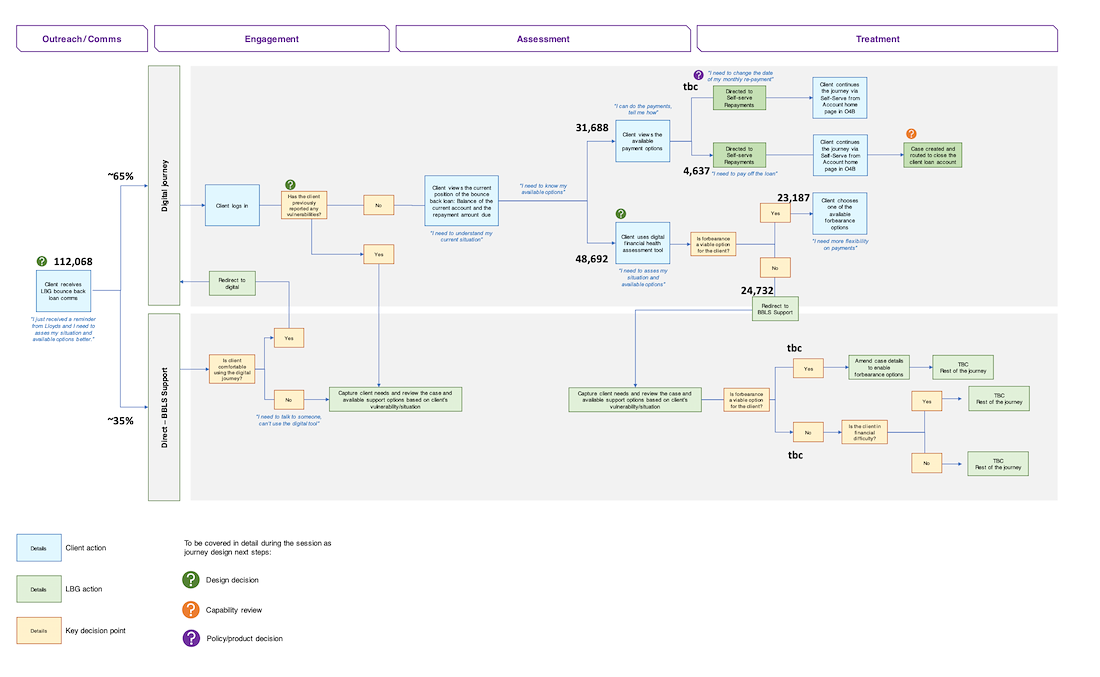

3- Journey Mapping & Service Blueprinting

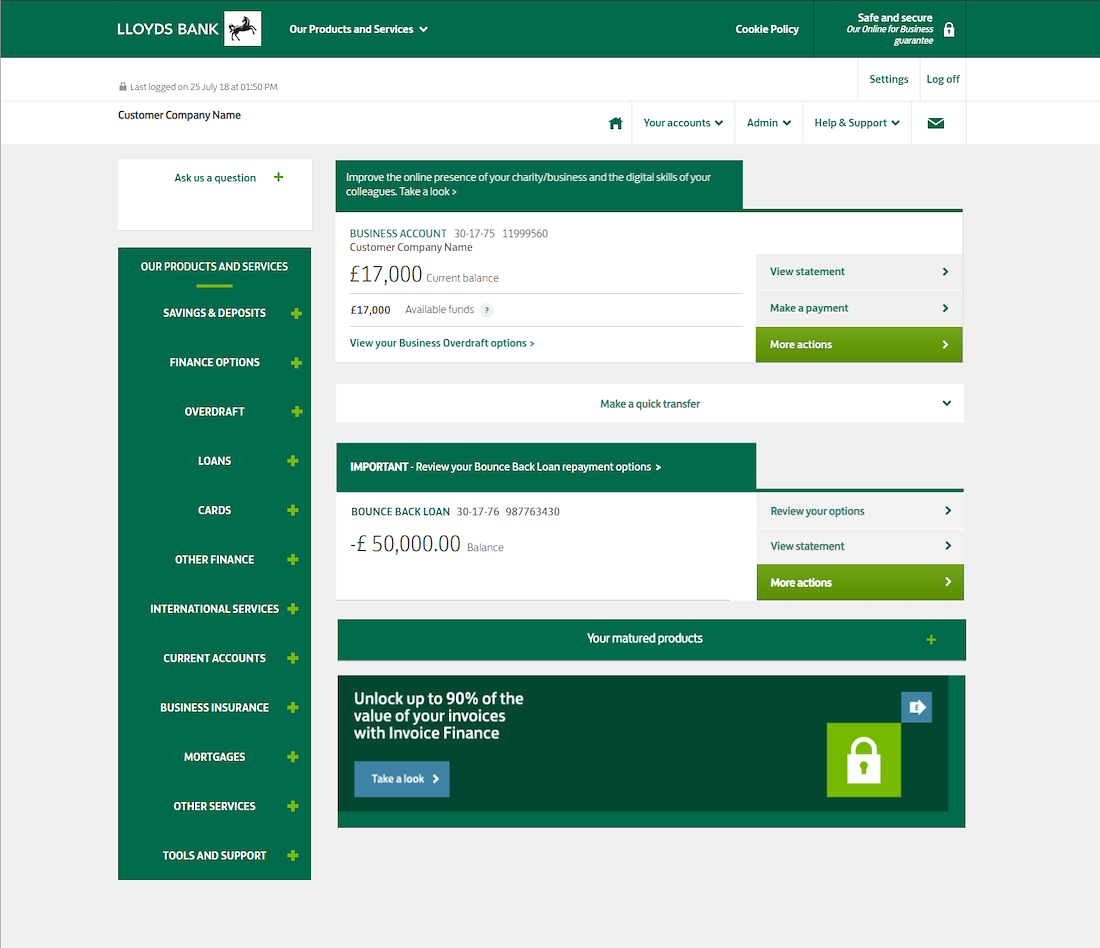

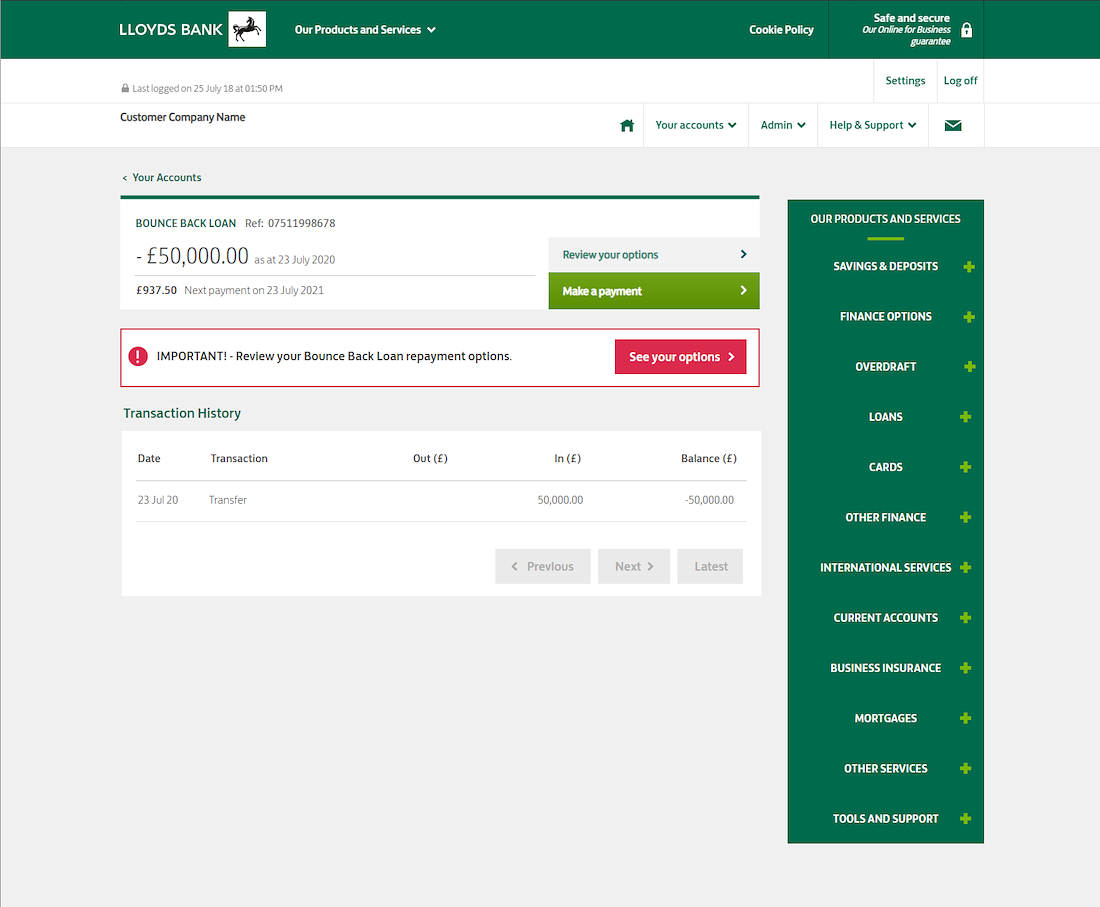

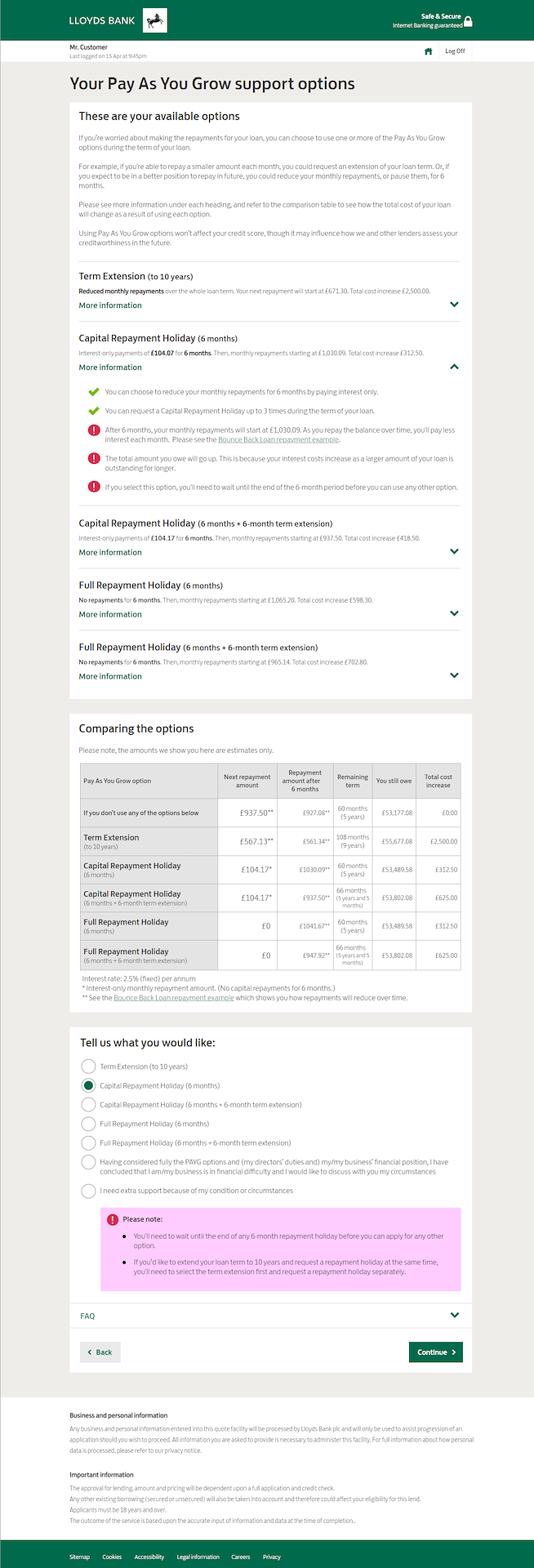

• Designed end-to-end flows for both digital self-serve and colleague-assisted journeys.

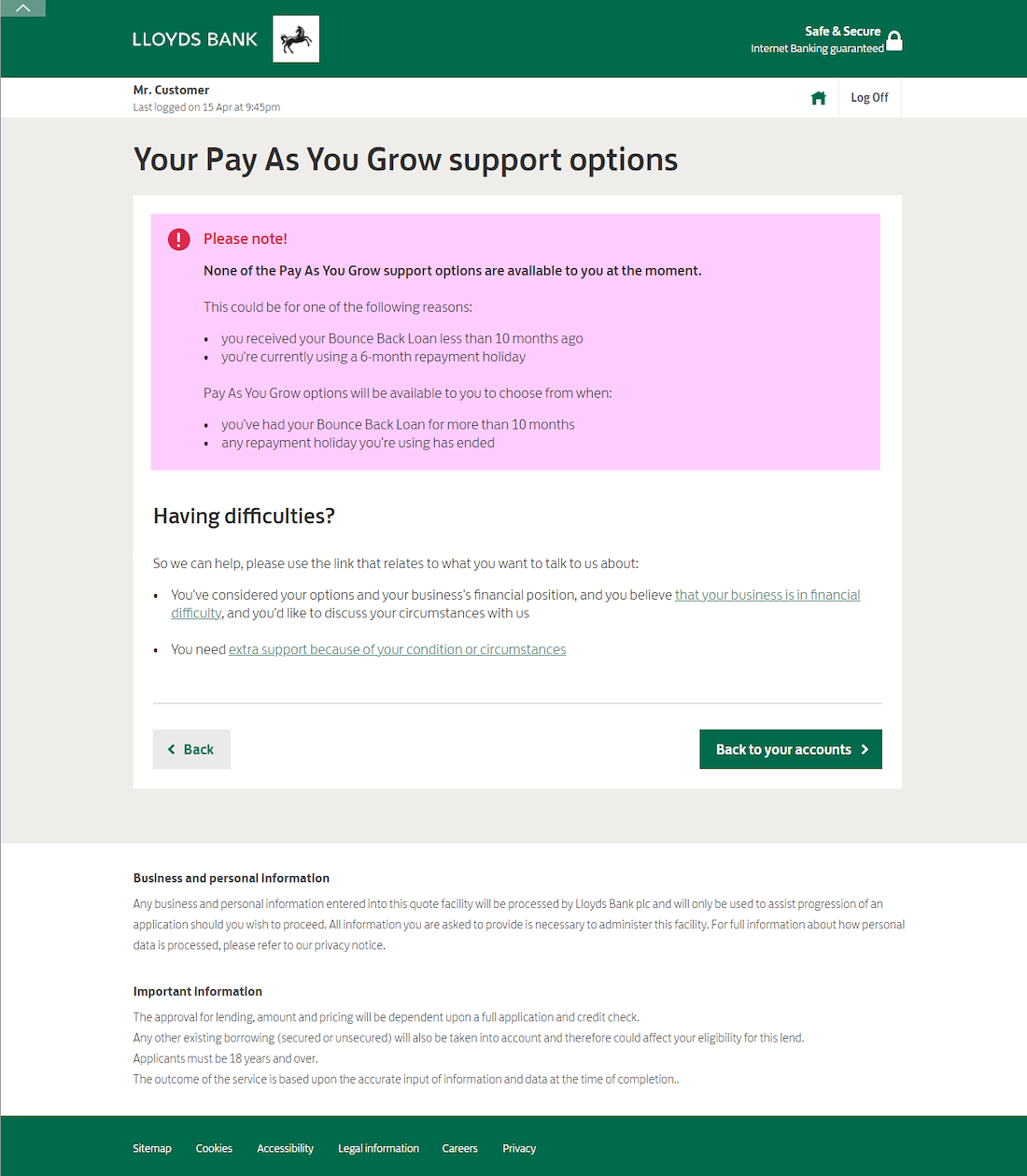

• Integrated decision points for arrears, ceased trading, or financial difficulty referrals for vulnerable customers that needed further assistance across both digital and offline channels.

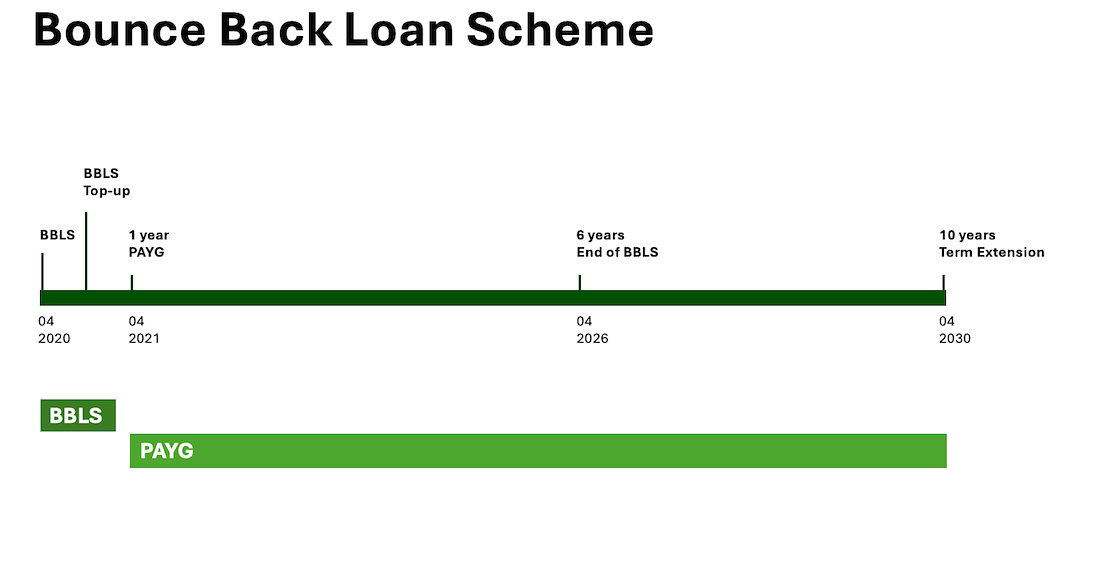

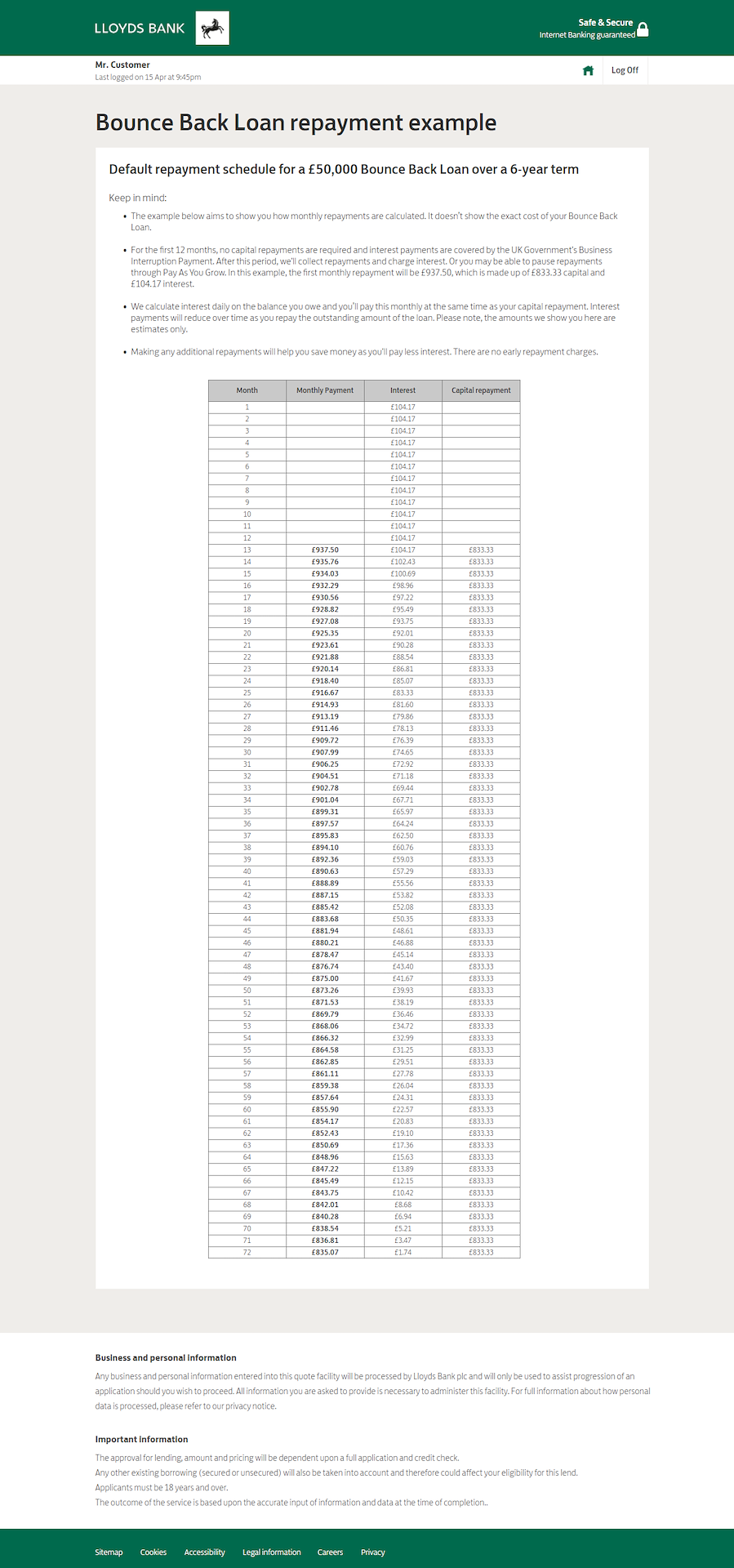

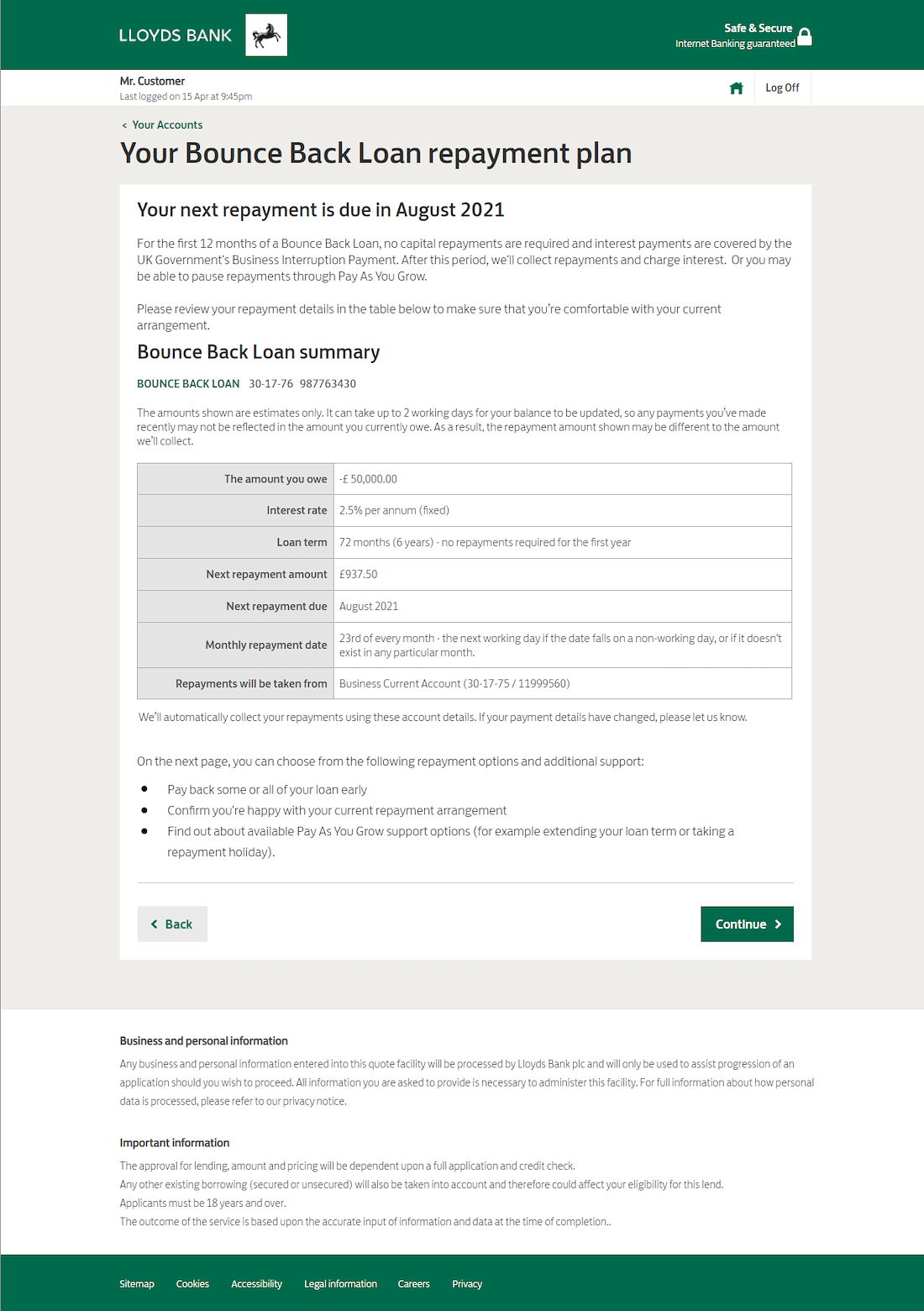

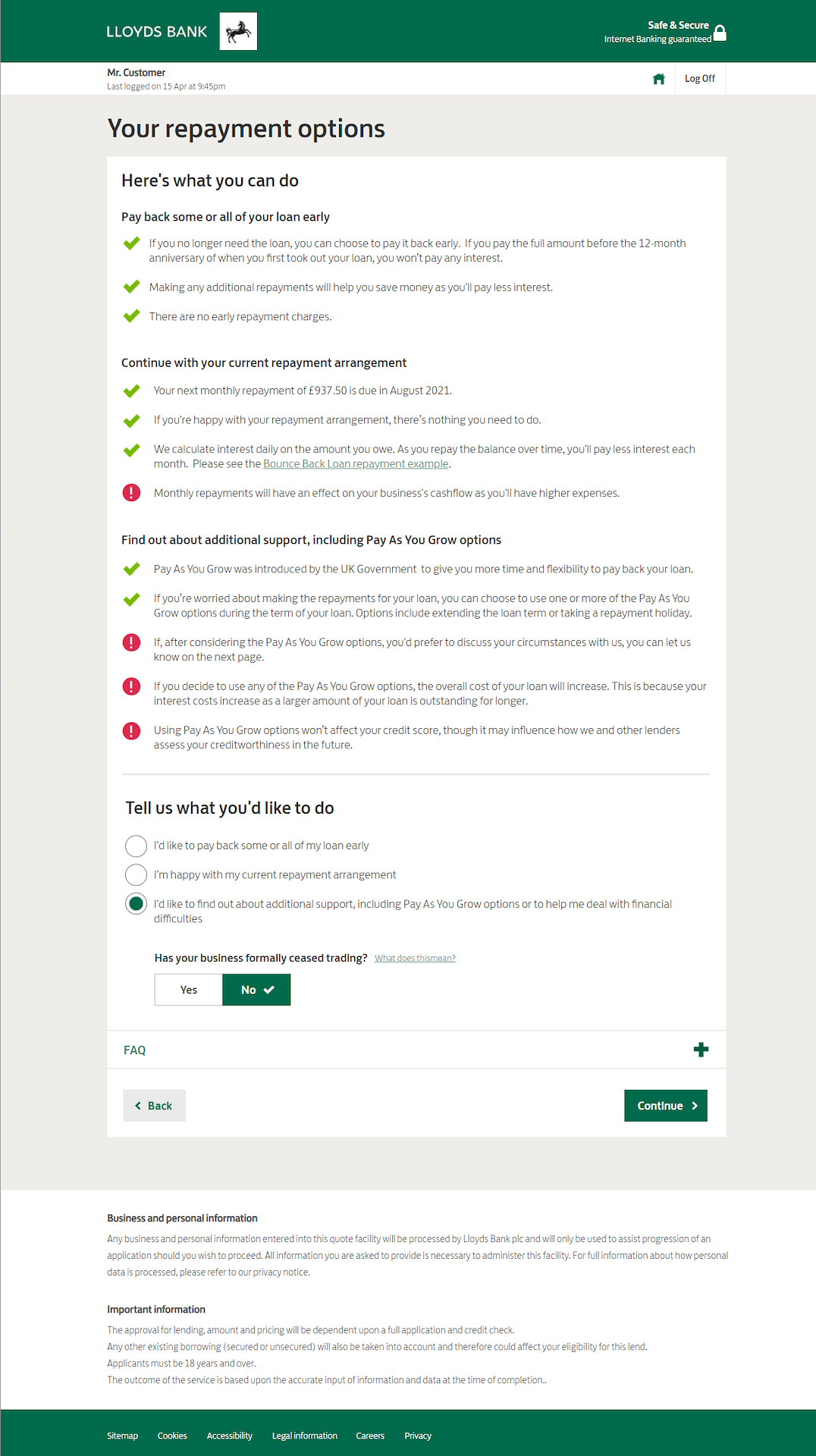

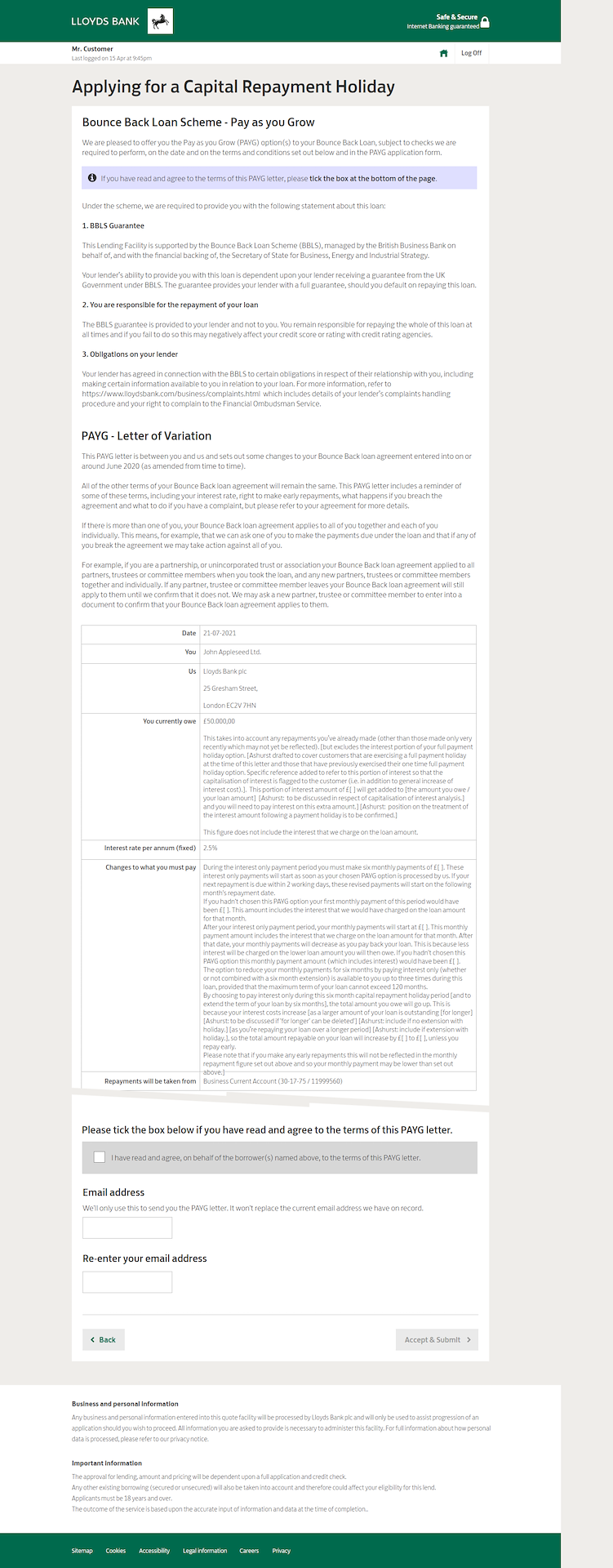

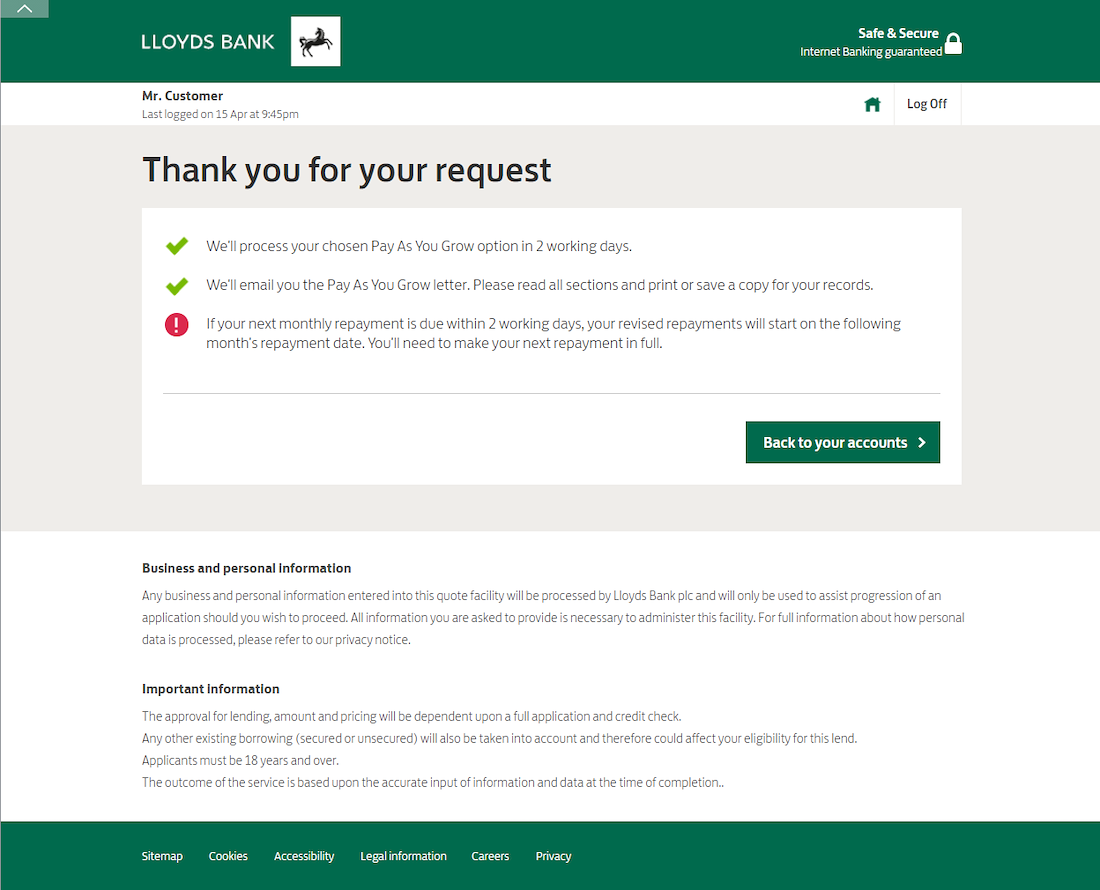

4- Digital Experience Design

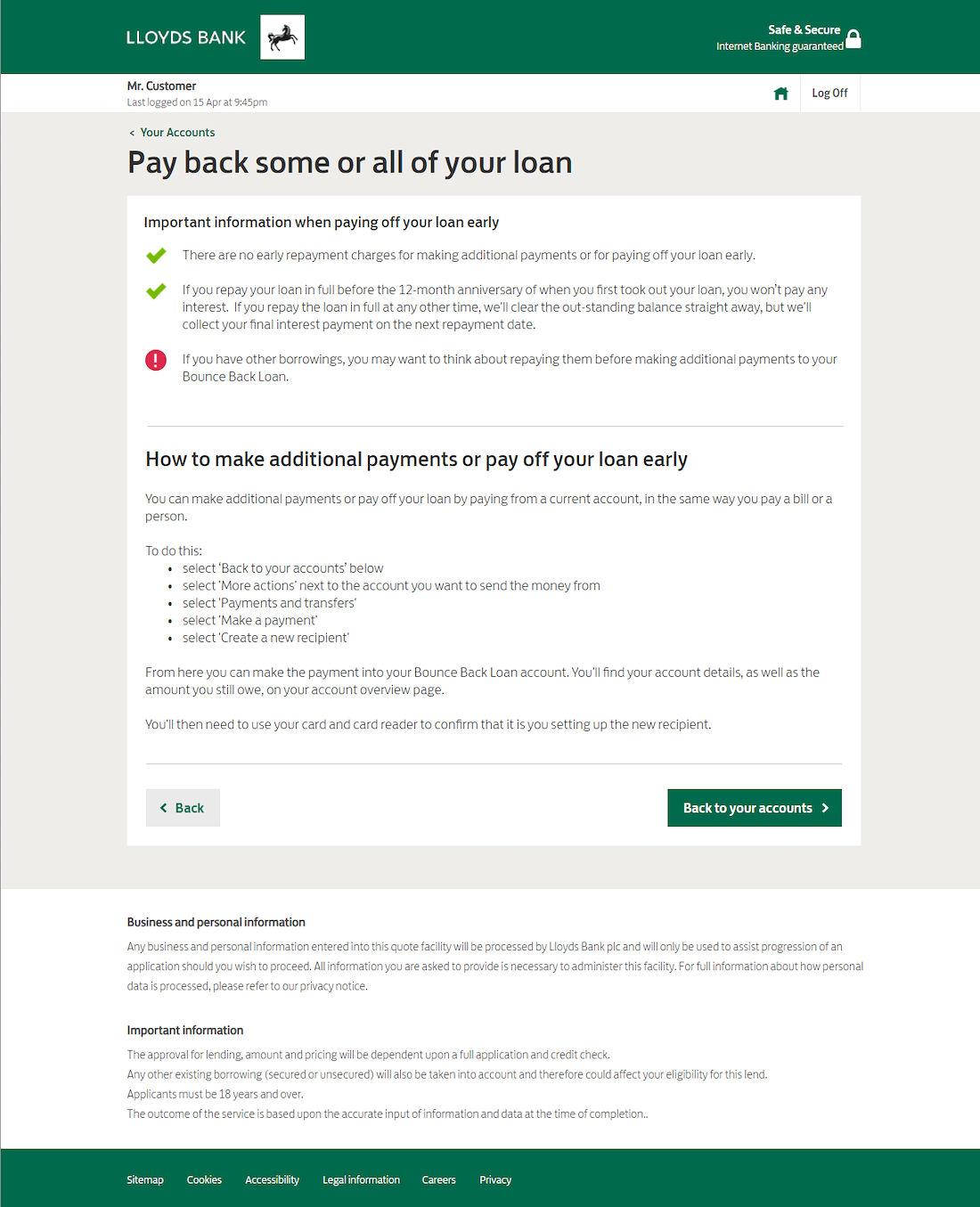

• Step-by-step UI flow: Loan overview → repayment position → PAYG options → eligibility checks → confirmation.

• Designed to minimise cognitive load in a high-stress decision environment.

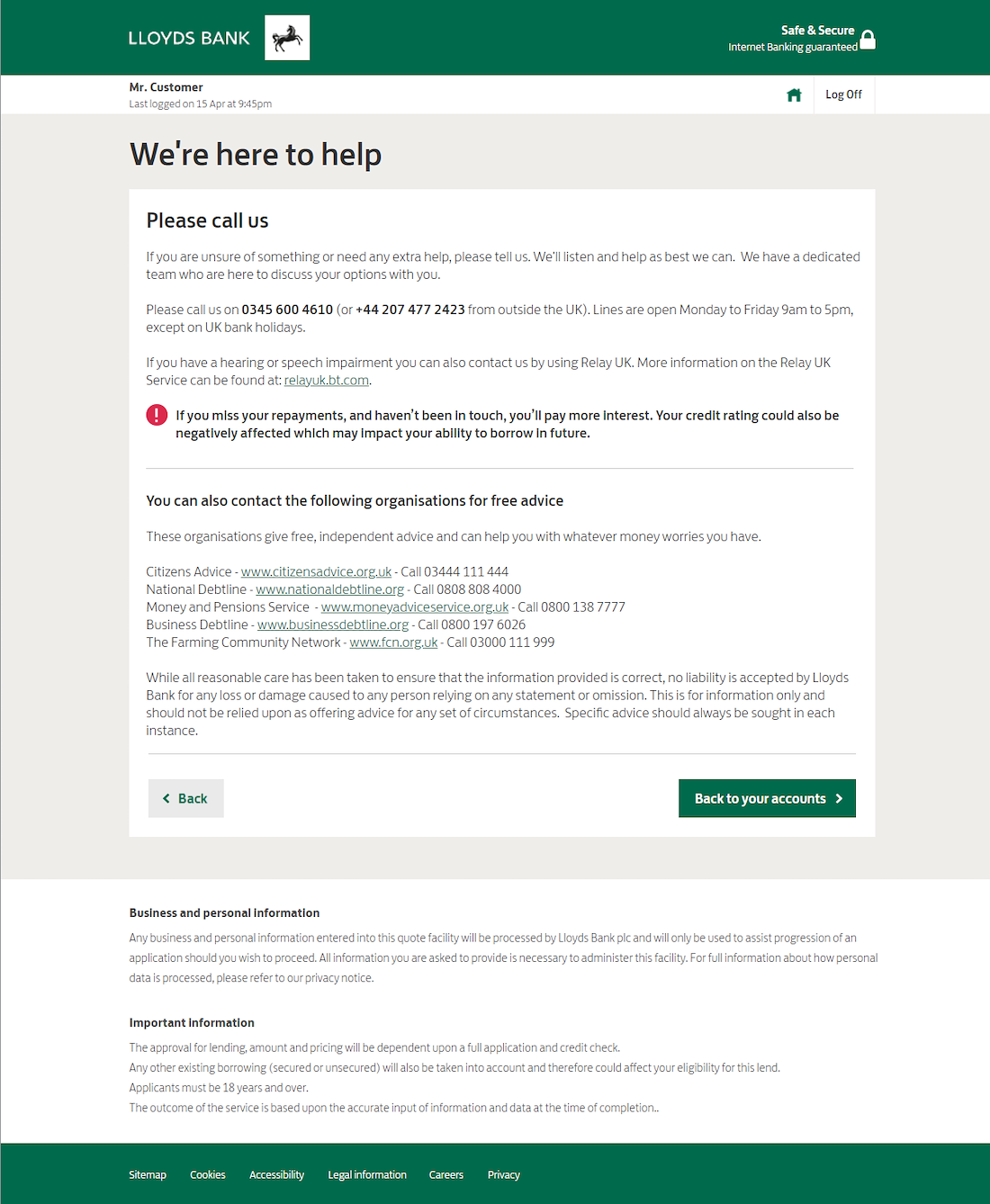

• Fail-safe paths for customers to request human support at any stage.

5- Operational Integration

• Defined handoff protocols between digital and telephony teams.

• Equipped colleagues with mirrored customer views for continuity.